By Adam Andrzejewski

The public’s support of small business is as all-American as apple pie. There’s no doubt that the success of mom and pop businesses on Main Street USA is an important aspect of the American Dream.

The Small Business Administration (SBA) is the federal agency charged with helping “Americans start, build, and grow businesses.” The administrator of the SBA is a cabinet-level position and has a powerful bully-pulpit.

Our OpenTheBooks investigation: U.S. Small Business Administration – Quantifying Lending Practices fact-checked the agency’s promises during the last five years (FY2014-FY2018). We simply asked: Where did the money go?

We discovered that $168.9 billion in loans and insurance guarantees were obligated and awarded.

However, taxpayers might be surprised to know that most of the money didn’t go to struggling small businesses. In fact, more than half (57-percent) of the SBA lending went to entities receiving $1 million or more.

When we asked the SBA to justify their practices, the agency spokesman actually blamed the lenders and passed the buck:

Lenders, not the SBA, determine which small businesses they want to lend to.

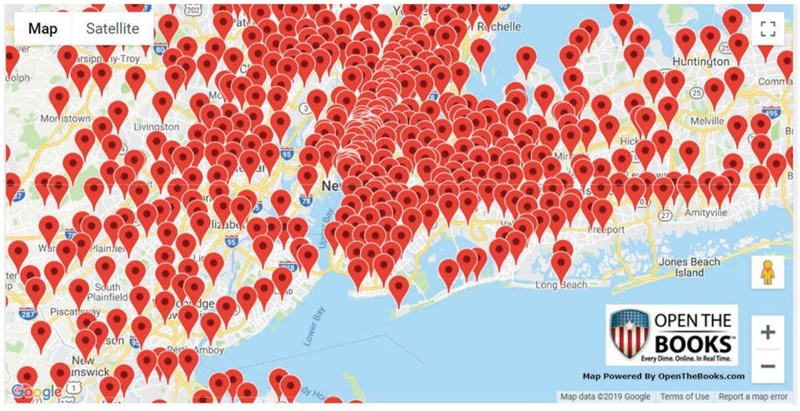

We discovered 40,000 recipients received $1 million plus during fiscal years 2014 through 2018. Since 2007, there were 75,000 recipients receiving $1 million or more. Last year, there were 9,332 recipients, up from 8,275 the previous year.

We mapped all of them – recipients of the SBA’s $1 million loans – by ZIP Code across the country. Search your own neighborhood. Just click a pin (ZIP Code) on our interactive search tool and scroll down to see the results rendered in the chart beneath the map.

Here are a couple examples of what you’ll find:

Wall Street Bankers: A significant portion of SBA lending didn’t go to Main Street; it went to Wall Street. In fact, $12.2 billion in lending flowed to highly capitalized venture capital, mezzanine finance firms, private investor funds and investment pools. That’s not small business.

Hercules Capital, Inc. in Palo Alto, California received $298.8 million in SBA funding over the years. It’s so successful that the firm is listed on the NYSE (HTGC) with a $1.3 billion valuation.

In March, however, its founder and CEO Manuel Henriquez was among those scoopedup in the college admissions alleged cheating scandal. Subject to a recent separation agreement with the firm, Henriquez will receive 692,841 shares of common stock (est. value: $9 million) and $2.5 million in cash.

Country Clubs: Since FY2007, our auditors quantified more than $280 million in lending to private country clubs, beach clubs, swim clubs, tennis clubs and yacht clubs across America. In the past five years, $120 million flowed to these exclusive clubs.

There were 74 yacht clubs across America who received a SBA loan or guarantee amounting to $35.5 million. A $4.2 million SBA-backed loan even found a yacht club in Oklahoma.

Our auditors found extensive SBA lending to the wealthy lifestyle, i.e. luxury resorts, plastic surgery clinics, high-end spas, exclusive diamond brokers, and more. Seven separate million-dollar loans funded high-end restaurants in Washington, D.C. One of them sells oyster plates as an $80 menu item.

Beverly Hills, California (90201, 90211, 90212): Businesses received $117 million including doctors with practices on Wilshire Boulevard. Even plastic surgeons and law firms received taxpayer subsidized loans.

More recipients included couture high-fashion design schools and retailers selling alligator leather belts for $750 and cowboy boats for $3,400. A 30-year importer of French wine received $1.75 million. An eyeglass designer whose frames are worn by Tom Cruise and Brad Pitt received $2.2 million.

Historically, the SBA has tried to justify their portfolio by saying that they operate on a “zero-subsidy.” In other words, their bad debt will be overcome by the gains from their lending portfolio. So, the taxpayer need not be concerned.

We reached out to the SBA for comment:

The SBA has operated at zero subsidy from 2016 – 2019 and believes the estimate it provided in the President’s Budget is an accurate reflection of the expected cost to taxpayers.

However, according the non-partisan Congressional Budget Office (CBO), the SBA’s “zero-subsidy” claims could be wildly off. The CBO forecasts that on $44 billion in lending during 2020, the taxpayer will subsidize 9.5-percent, or roughly $4 billion.

We also found that Congress appropriated approximately $3.5 billion to cover SBA administrative and programming costs over the past five-years. That’s a big taxpayer subsidy that the SBA chose to ignore.

The SBA also has a problem with basic internal financial controls and admitted to $924.5 million in improperly paid “over payments” just last year. The agency cited its “inability to authenticate [borrower] eligibility,” and “administrative or process errors made by the agency.”

Our report shows that the SBA is in dire need of congressional oversight. The public should be asking some hard questions:

- How were these industries chosen? What’s the public purpose to ask working and middle-class citizens to subsidize those businesses?

- During a period of unprecedented economic prosperity, why does the SBA allow so much lending on million–dollar plus loans?

- What about the SBA lending to the Wall Street bankers?

When a SBA-backed loan transaction is approved, taxpayer money (guarantees) are used to pit one taxpaying business against another. Who decides who wins?

Is it the market, or the swamp? Taxpayers deserve to know.

Review the full responses from the SBA spokesman Jimmy Billimoria, here.