The mission of the U.S. Small Business Administration (SBA) is to provide lending to "Mom and Pop" businesses on Main Street. The recipients are supposed to be entrepreneurs with great ideas who just can’t find financing in the private marketplace. The public image is one of apple pie, baseball and the American Dream.

But the reality is that the SBA is economically costly for taxpayers, and it creates a painful human cost for the workers it dislocates.

In 2014, we documented at Forbes, SBA lending to the wealthy lifestyle: Lamborghini auto dealerships, Rolex jewelers, world-class golf courses, private country clubs and even $142 million lent to businesses in ZIP code 90210, Beverly Hills, CA.

Now, we’ve published our OpenTheBooks Snapshot Oversight Report – Truth in Lending: The U.S. Small Business Administration’s $24.2 Billion Bad Loan Portfolio. Analyzing the SBA portfolio since 2000, we discovered 160,000 failed loans were charged-off to the tune of $17.5 billion. In other words, taxpayers absorbed those costs. Meanwhile, 1.4 million workers were dislocated when they lost their jobs within these failed companies. A few highlights:

- In some years, such as 2007, one of every three SBA loans was "charged-off" against taxpayers.

- We found that the Big Six Wheel ‘house odds’ at a Las Vegas casino are a better bet than large tranches of the SBA loan portfolio.

- The $24.2 billion bad loan portfolio at the SBA (2000-2015) is larger than the annual budgets of 26 states.

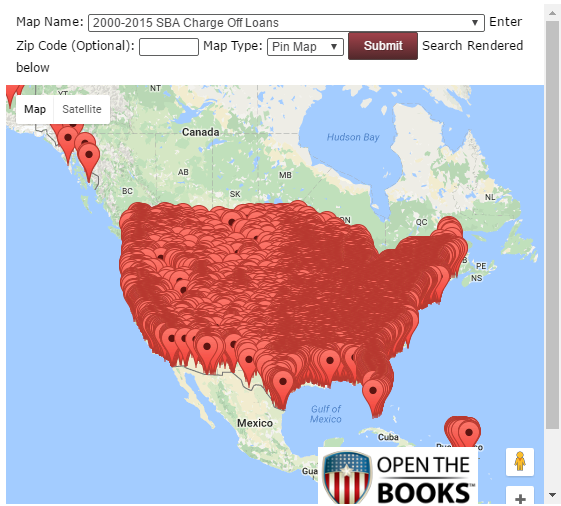

We mapped the bad loans by ZIP code across America. Just zoom-in, click a pin, and review the search results in your neighborhood or across the country rendered in the chart below the map.

So who "gamed the most" from this taxpayer-backed boondoggle at the SBA?Nothing should rankle taxpayers more than $160 million lent to the nations country clubs and golf courses by the SBA since 2007. Many now-defunct clubs and courses received $61.4 million in SBA lending since 2000 and $44.6 million was charged-off against taxpayers.

Wealthy free-loaders that charged-off their loans include Canterbury Woods Country Club ($1.2 million), ranked as the #3 public golf course in New Hampshire; and Wildhorse Golf Course ($1.4 million), ranked as the best golf course in Yolo County, California and specially designed by course architect, Jeff Brauer.

Large corporations gamed the system by subdividing their businesses into "small business" franchises to qualify for the low interest, government guaranteed loans. Taxpayers – through the SBA – underwrote the national rollout and distribution plans of these companies. Many of these loans defaulted.

Here are some examples:

- Four national hotel chains defaulted on more than $350 million: Choice Hotels ($95.3 million), Holiday Inn ($88.4 million), Comfort Inn ($88.7 million), and Days Inn ($81.9 million).

- In the convenience store/gas station industry, more than $562 million was squandered in failed lending. Familiar names appearing throughout the list include Phillips, Conoco, Shell, Marathon, Citgo, Texaco, Chevron, Hess, and BP. Since when did a small business loan become a give-away to big oil?

- The restaurant, bar, brewery and winery industry combined for a total of $2.2 billion in SBA defaults. More than $107 million in failed lending backstopped the national rollout of just two franchises: Quiznos ($58.1 million) and Cold Stone Creamery ($49.1 million).

Meanwhile, SBA bankers didn’t even have the foresight to see the coming digital electronic revolution and squandered millions on outdated business models.

Throughout the 2000’s, the SBA lent $412 million to book printers, commercial printers, paper mills, printing and writing paper wholesalers, print ink manufacturing, newspaper mills, lumber mills, and even "manifold business form printers." Many of the loans were large and the top 92 were each worth more than $1 million.

Call it recycled failure funded by taxpayers. Not surprisingly, taxpayers were literally stuck with hundreds of millions of dollars in worthless paper.

During the 2000’s, the SBA put $25 million into travel agencies and reservation firms while the whole world moved online to Orbitz and Priceline. In 2007, the largest loan went to a travel agency called Florida Holidays for $1.4 million, of which nearly $800,000 was charged-off. The intermediate lender was none other than the Federal Deposit Insurance Corporation (FDIC).

Incredibly, from 2002 through 2008, SBA bankers bet heavily on the video cassette tape industry while obligating taxpayers for $60 million in lending. In an egregious spree from March 7-22, 2006, the SBA lent $3.8 million to three Blockbuster Video stores in Plymouth, Middlesex and Bristol, Massachusetts.

Taxpayers ate every dime of now-worthless tech garbage.

The incompetence of the SBA bankers shows up in lending to the ‘sin’ industries as well, i.e. liquor stores, cigarette retailers and manufacturing. While government tried to legislate these companies out of business, our data at OpenTheBooks.com shows that the SBA sent $158.4 million to these now-defunct entities who later charged-off their loans.

Here are a few other examples of SBA failure: $126.6 million was pumped into bankrupt "Advertising Agencies" and public relations firms. Lending of $31 million went to now- nonoperational firms specializing in direct mail ($14.1 million), and display advertising ($17.8 million). Upscale jewelry stores received $108.2 million in loans where the charge-offs exceeded $76 million.

Even a couple Lamborghini auto dealerships got in on the action, sticking taxpayers with an Illinois-based loan for $1.2 million and one in Ohio for $213,000.

Government has a knack for picking losers over winners and, as our report shows, no one has does that more consistently than the SBA.

Adam Andrzejewski (say: And-G-eff-Ski) is the Founder and CEO of OpenTheBooks.com – the world’s largest private repository of government spending that’s publically accessible with 3 billion individually captured expenditures from the Federal, State and Local levels across America. To download our report, click here.