Chinese Communist Defense Contractors Reaped $200- $400 Million In U.S. Covid Relief Payments

April 19, 2021

Yes, it is PPP for the CCP.

A Covid relief program – Paycheck Protection Program (PPP) – meant to help U.S. small businesses on Main Street was hijacked by 125 defense firms with strong ties to the Communist Chinese Party (CCP). A legal loophole sent millions of taxpayer dollars to Chinese companies.

The $660 billion Paycheck Protection Program created in March 2020 to help struggling small businesses in the U.S. has allowed American subsidiaries of foreign companies to get the forgivable loans, sending millions to Chinese companies, according to The New York Times.

The paper cited a study from strategy consulting firm Horizon Advisory that combed through loan data available to the public and found that more than 125 companies that Chinese entities own or invest in had received $192 million to $419 million.

At least 32 Chinese companies received loans of more than $1 million, the report found.

Nanjing Xinbai, a Chinese state-invested company whose controlling shareholder is tied to the Communist Party, owns Dendreon Pharmaceuticals, a California-based biotech company, which received a loan worth $5 million to $10 million.

Aviation Industry Corporation of China, a Chinese military company, owns Continental Aerospace Technologies, which got a loan of up to $10 million, and Aviage Systems, which collected a loan of up to $350,000.

China’s HNA Group, a real estate, aviation, and financial services transactions company is part of the Fortune Global 500 and owns HNA Group North America LLC and HNA Training Center NY, both of which received loans of up to $1 million.

By talking about taking on our biggest economic rival while leaving a loophole to fund China’s state-owned companies with American taxpayer dollars, our leaders’ words are nothing but lip service.

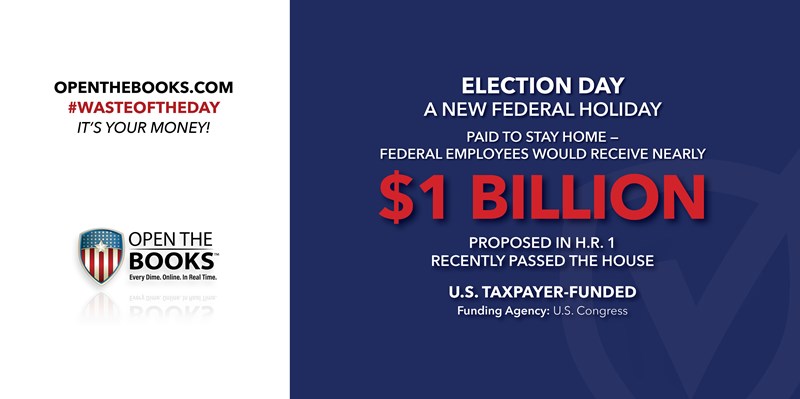

Nearly $1 Billion in Taxpayer Cost – If Election Day Becomes a New Federal Holiday

April 20, 2021

Forty-three states and the District of Columbia offer in-person early voting for between four days and 45 days, for an average period of 19 days.

But new legislation (H.R.1) – that just passed the U.S. House – seeks to give federal workers a paid day off on Election Day. Estimated taxpayer cost? $818 million every two years or more than $4 billion over a ten-year period.

The Democrat-led House passed the bill in March and still needs to pass the Senate. Supporters say it seeks to strengthen voting access.

Of those 43 states and the District of Columbia, 24 states and the nation’s capital allow some weekend early voting, according to a state-by-state comparison by the National Conference of State Legislatures.

That organization also notes that only 16 states require voters to provide a reason for why they cannot vote on Election Day and need mail-in absentee voting.

The other 34 states and Washington, D.C., do not require an excuse to vote absentee or by mail.

H.R.1 would require states to have early voting for 15 days before Election Day, for a minimum of 10 hours each day and to allow no-excuse absentee voting by mail.

Most states are already doing one or both of these things, but the supporters of H.R.1 would have the public believe that Americans are being disenfranchised.

However, the reality is that voters have plenty of opportunities to cast ballots.

$1.7 Trillion Federal Budget Deficit in March – Up 454%!

April 21, 2021

A recent article by The Wall Street Journal outlines how, as stimulus money flowed to states and taxpayers, the U.S. budget gap widened to a record $1.7 trillion in March, 454% deficit growth.

The spending, well-intentioned to help the economy during the disastrous pandemic, sent the federal debt sky high to levels unheard of since the end of World War II as a proportion of the economy.

The budget gap is now more than double what it was for the same period last year, the U.S. Treasury Department said.

While revenue rose 13% to $268 billion, the WSJ reported, spending increased 161% to $927 billion, making it the third-highest total on record, only after June and April of 2020.

And President Joseph Biden just proposed another $2.3 trillion in spending on infrastructure and other plans.

The spending plan has been criticized by Republicans, who are hoping to get a much narrower infrastructure bill that does not include tax increases on corporations and additional spending, which could further damage the country’s deficit.

“While much of the borrowing of the past year was unquestionably warranted, we are now becoming dangerously numb to the trillions in debt that are piling up,” Maya MacGuineas, president of the bipartisan Committee for a Responsible Federal Budget, told WSJ. “We need to start paying for what we spend. We need a plan to bring down the debt.”

Spending our way out of an economic downturn only sounds like a decent plan until the bills come due.

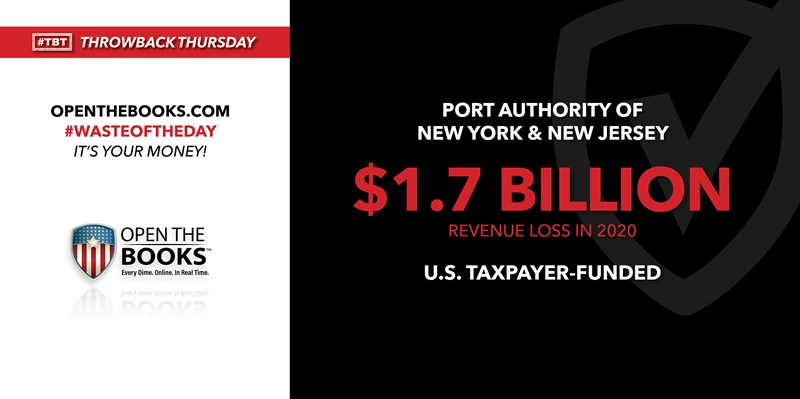

$1.7 Billion Revenue Loss for The Port Authority of New York and New Jersey

April 22, 2021

Throwback Thursday!

The Port Authority of New York and New Jersey is facing a $1.7 billion revenue loss because so few people were driving during the Covid-19 pandemic, yet its workers get the benefits of an expensive pension plan and bloated overtime.

Looking back, a Port Authority police lieutenant retired in 2013 with a $129,000 salary and then began collecting a $172,000 pension.

An assistant airport operations manager retired with a $89,000 salary, but soon began collecting a $103,000 pension.

An electrician with a base salary of $76,000 quit and started collecting a pension of $79,000.

In 2016, our auditors at OpenTheBooks.com created a database of Port Authority salary and retirement records and found that its government employees are among the highest paid.

In 2014, the Port Authority spent $1.19 billion on pay and benefits, averaging more than $150,000 per employee.

A 2011 audit from the New York state comptroller said "overtime flows like water" at the agency. In 2014, 5,360 employees were paid overtime, about 100 of whom effectively doubled their base salary.

Back then, the Port Authority was facing $20 billion in debt and had raised tolls on residents and businesses.

The tolls remain high and now The Port Authority’s $7.3 billion budget for 2021 includes plans to sell $3.6 billion of bonds to deal with massive revenue losses.

Utah Gets a $1.5 Billion Congressional “Bailout” – Utah Already Had a $1.5 Billion Budget Surplus!

April 23, 2021

Blessed with an embarrassment of riches, Utah will have a $1.5 billion surplus and get a match from the federal government.

The Beehive State is collecting another $1.5 billion in federal stimulus funds from The American Rescue Plan. The coronavirus “bailout” for Utah is just part of the $350 billion in aid for state and local governments after a year of pandemic shutdowns and struggling economies.

But for Utah, its economy has been able to withstand the downturn that has hurt other states.

As Gov. Spencer Cox said in a press release about the financial health of the state, Utah’s economy has long-term strength.

“Key indicators continue to show that the Utah Way has again paid dividends, with our state leading the nation in the economic recovery,” Cox said.

That “Utah Way,” including “prudent use of taxpayer resources,” allowed for a $1.5 billion surplus.

The governor credited the extra money after an unprecedented year with the “Utah economy performing exceptionally well relative to expectations in the beginning months of the pandemic."

So why did the state get $1.5 billion from the federal stimulus?

The spending plan made no distinction between states that managed its finances well and states that didn’t, between states that had extensive shutdowns and those that didn’t, between states that have gotten some of its tourism dollars back and those that haven’t welcomed tourists back.

And no state has turned down the “free” money from the federal government.

The #WasteOfTheDay is presented by the forensic auditors at OpenTheBooks.com.