Pandemic Over, But Government Continues to Spend Millions

September 18, 2023

Despite the World Health Organization and the Centers for Disease Control and Prevention declaring an end to the Covid-19 pandemic, the government continues to invest in Covid-19 prevention equipment and measures. A sampling of USASpending.gov records found four new contracts, amounting to $6.5 million, within several weeks related to Covid-19.

On May 11, 2023, the U.S. Public Health Emergency related to the coronavirus pandemic ended. Despite this, agencies like the Department of Veterans Affairs and the Department of Defense continue to spend millions on Covid-19 related contracts.

The Department of Veterans Affairs made multiple investments to fight Covid-19. On August 14, it spent $1.7 million on a contract for “ensuring adequate Covid-19 protocols for federal contractors.” Then, on August 18, it spent $1.3 million on Covid-19 testing materials. Yet another contract is set to begin on September 22, this one for $2 million for more coronavirus, HIV, and HPV tests.

The DOD is also spending money on Covid-19, with a contract beginning Oct. 1 worth $1.5 million for Covid-19 tests for Madigan Army Medical Center.

This is just a small sample of likely tens of millions in Covid-19 expenditures across the government. It’s perplexing why the government continues to spend money on these, since its own health agency has declared the Covid-19 emergency over, as has the World Health Organization.

Additionally, there are likely countless unused coronavirus tests and personal protective equipment still around after massive purchase orders, making it unclear why massive new investments are needed.

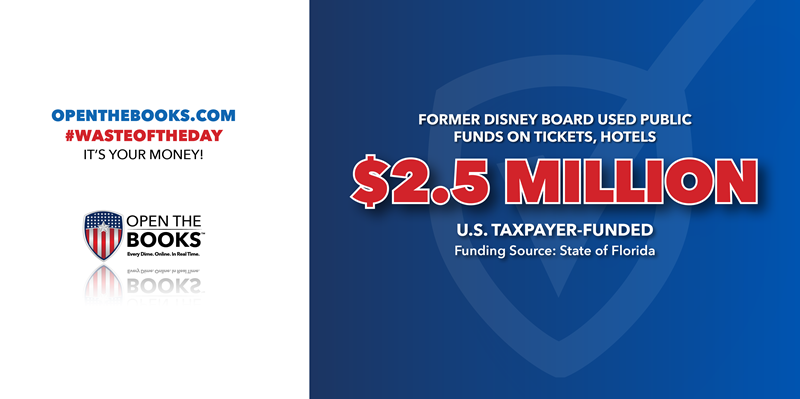

Special District in Florida Allegedly Spent $2.5 Million on Disney Tickets, Hotels

September 19, 2023

Board members of what was formerly known as the Reedy Creek Improvement District in Orlando, Florida, allegedly spent $2.52 million of taxpayer funds on excursions to Disney World, including tickets and discounts on food, merchandise, and hotels, according to Deadline.

The district was a special governmental body created to govern the land that Disney World owned and operated. According to its website, the board has the same governing authority and responsibility as any other county government.

The Board was recently replaced by Florida Gov. Ron DeSantis as part of his battle against Disney. Now, the new board of the Central Florida Tourism Oversight District has asked the Florida inspector general to investigate expenditures of $2.5 million made by the former board members, who allegedly used taxpayer dollars to purchase passes to Disney World and get discounts on Disney food, merchandise, and hotels.

In a statement, the new board said, “For decades, the former Disney-run RCID used taxpayer funds to provide season passes and amusement experiences to its employees and their family members, cover the cost of discounts on hotels, merchandise, food, and beverages, and give its own board members VIP Main Entrance passes. In 2022 alone, it cost taxpayers over $2.5 million.”

According to the statement, $492,382 was spent on tickets, while $16,837 was spent on merchandise discounts, $4,969 went to food and beverage discounts, and $3,764 went to waterpark discounts, among other expenditures on hotels.

State law caps board member compensation at $100 per month, which raises questions about the purpose and legality of these expenditures.

If these allegations are true, they’re not only a waste of taxpayer money, but also a conflict of interest between Disney and the board that is supposed to oversee them. Public servants need to avoid conflicts of interest both in fact and appearance, and these expenditures present troubling questions of independence.

Flawed Federal Government Accounting Miscalculates $66 Billion in Costs

September 20, 2023

The federal government is using a flawed accounting method, which is likely underestimating the costs of a loan program by $66 billion, according to a new report from the Congressional Budget Office.

According to the CBO, the government uses a procedure from the Fair Credit Reform Act of 1990 to make cost estimates for the federal budget. While this method is required by statute, CBO notes that another estimation method, fair value estimation, could be more accurate, as it measures the current market value of government obligations.

The government estimation method puts cost estimates for new loans and loan guarantees issued in 2024 at $10.9 billion over their lifetime. Using the fair value estimation method, however, raises the cost to $76.7 billion, about seven times the federal estimate.

The discrepancy is largely attributable to loan guarantees made by Freddie Mac and Fannie May, the U.S. Department of Housing and Urban Development’s loan guarantee program, and the Department of Education’s student loan program.

In each case, the government’s method estimates these loans saving billions, while fair value estimates suggest they would cost billions. In the case of the student loans, the cost discrepancy between methods is a difference of $44.7 billion.

The CBO notes the fair value method accounts for market risk, which accounts for macroeconomic conditions like productivity and unemployment, which makes it, in its opinion, “a more comprehensive measure than FCRA [government method] estimates.”

Lawmakers and their constituents need to be informed of the true cost of legislation. Using archaic accounting methods that don’t account for real world market risk obscures the true price tag of spending programs.

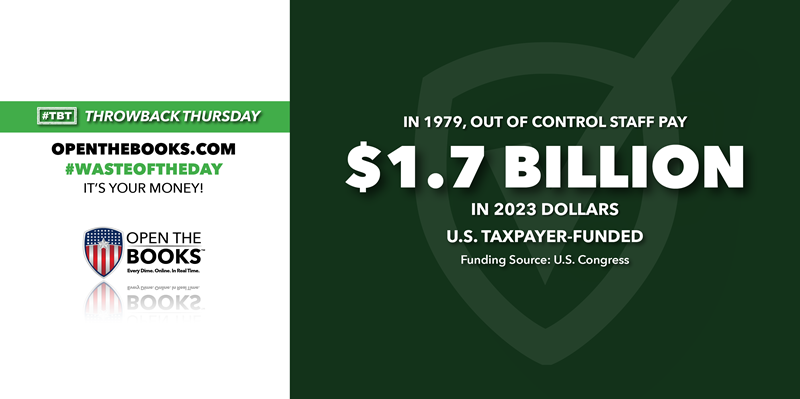

Throwback Thursday: Congressional Staff Salaries Increased 270%

September 21, 2023

Throwback Thursday!

From 1969 to 1979, the number of staff members in the U.S. House and Senate increased from 10,700 to 18,400, with an increase in salary expenses of $400 million – worth $1.7 billion in 2023 dollars.

Sen. William Proxmire, a Democrat from Wisconsin, gave his own legislative body the Golden Fleece Award for this explosion in staff and salaries.

According to Proxmire, the increase in pay was substantially higher than the increase in headcount. While headcount only increased by 70%, pay increased 270%. In the Senate alone, staff headcount increased by 100% from 3,400 to 6,800, bringing the number of staff per Senator up to 68 by 1979.

Other Congressional support services also bulked up. Capitol Police saw its ranks grow from 602 to 1,187 over a decade, a 97% increase. New administrative and support entities like the Office of Technological Assessment, the Congressional Budget Office, The Architect of the Capitol, and the Congressional Research Service also sprang up, adding to the staffing increase.

Proxmire admitted that some of the increased staffing is a good thing, because some staff directly help elected officials do their jobs more efficiently for their constituents. It is also helpful to give better oversight to an increasingly growing executive branch.

Other staff, however, are excessive and duplicative. In one case, at a committee meeting, 27 staff were present to support two members of Congress.

Congress should be judicious about its staff numbers and pay, and always be careful to balance enough staff to effectively do its job without wasting taxpayers money.

With Only $55 Million in Coffers, Los Angeles Plans to Spend $150 Million From Tax

September 22, 2023

While only roughly $55 million has been raised from a possibly unconstitutional mansion tax in Los Angeles, the City Council recently passed a spending plan for how to use $150 million — when it comes in.

L.A.’s mansion tax redistributes money from the sales of houses above $5 million. The law, which took effect on April 1, charges 4% on all residential and commercial real estate sales in the city above $5 million and a 5.5% charge on sales above $10 million.

But the city’s new tax is facing lawsuits questioning its constitutionality, with the possibility that the city may have to pay those funds back after it spends them on eviction defense, income support for rent-burden seniors, rent debt assistance, and more.

Initially, proponents estimated the tax would raise about $900 million per year, but a March report from the City Administrative Office lowered that number to $672 million, The Los Angeles Times reported.

“But once the tax took effect, L.A.’s luxury market froze,” The Times reported. “Only two homes sold for more than $5 million in the month of April, and the market hasn’t quite recovered since.”

Luxury homeowners seeking to avoid the tax have either refused to sell their homes or hired tax specialists to find loopholes, The Times reported.

Now, Mayor Karen Bass projected only $150 million in revenue from the flawed tax — with $55 million at the moment — an amount the city will have to return if the law gets overturned.

With far less money coming in because of the freeze on sales, an option to overturn it on next year’s ballot, and lawsuits, the City of Los Angeles should call an audible and admit it made a mistake.

The #WasteOfTheDay is presented by the forensic auditors at OpenTheBooks.com.