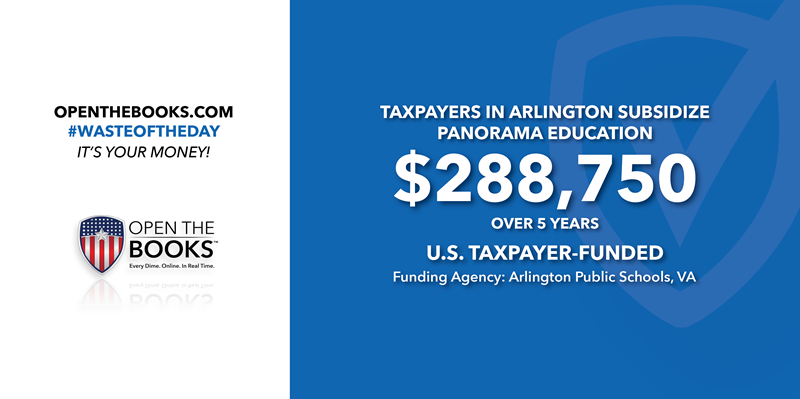

Arlington Public Schools Paid Panorama Education $288,750 Over Five Years for Three Surveys

October 18, 2021

Attorney General Merrick Garland’s memo to the head of the FBI, directing him to work with local law enforcement “to address threats against school administrators, board members, teachers and staff” has received plenty of attention.

Recently, it has become clear that Garland’s son-in-law is Xan Tanner, co-founder, board member, and president (2012-2020) of Panorama Education.

Panorama Education sells surveys to school districts across the country that focus on the local “social and emotion climate.” These surveys are then used as justification for new curriculum from other providers that some parents call critical race theory and find objectionable.

Critics say Garland is weaponizing the DOJ and trying to silence parents who are concerned with what their children are being taught in schools.

It’s a conflict of interest for the AG to instruct the FBI to investigate parents who might pose a financial threat to his son-in-law’s business, critics also allege.

Tanner’s company has a large footprint with contracts in 50 of the nation’s 100 largest school districts. The company describes its business as supporting “13 million students in 23,000 schools and 1,500 districts across 50 states.”

A 2017 contract between Panorama and Arlington Public Schools in Virginia shows the data company provided three school-wide surveys over five years, costing taxpayers $288,750.

The 28-page contract includes a fee schedule that shows 345 hours billed at $250 per hour for consultants to design surveys and render “analysis and reporting,” while project managers billed $125 an hour for 1,230 hours.

The spring 2020 Arlington social and emotional climate survey is posted online.

Questions include: “how clearly do you see your culture and history reflected in your school?” and “how often do you feel that you are treated poorly by other students because of your race, ethnicity, gender, family’s income, religion, disability, or sexual orientation?”

While that’s not nearly the totality of the survey, it feeds into parents’ fears that their children are being subject to sensitive race-related teachings. It also supports the argument that the AG is conflicted in calling in the FBI in an area where his son-in-law is heavily invested.

Taxpayers Subsidize Manhattan Gallery Showcasing Hunter Biden Art

October 19, 2021

A Manhattan art gallery exhibiting and selling artwork from Hunter Biden, son of President Joe Biden, received $580,000 in taxpayer-funded Covid-19 relief aid, about half of which came after Biden took office.

The Georges Berges Gallery only has two employees but it received a $150,000 “disaster assistance loan” from the Small Business Administration last year, according to public records, the New York Post reported.

The SBA later “revised” the loan, approving another $350,000 on July 26, shortly before the gallery exclusively marketed 15 paintings by Hunter Biden, public records show.

In addition to the loans, the SoHo gallery collected almost $80,000 in two payments in April 2020 and February 2021 under the SBA’s Paycheck Protection Program, to help businesses pay their employees during the pandemic.

The newspaper noted that while there’s no evidence that President Biden helped secure the additional $350,000 loan, watchdog group National Legal and Policy Center found that of the more than 100 galleries in New York City’s 10th congressional district, which includes SoHo, TriBeCa and Chelsea, the Georges Berges Gallery received “by far” the largest forgivable SBA disaster loan.

“We’ve reached a new low in American politics where the president’s son gets his midlife crisis art career subsidized by the American people as part of our pandemic response to Covid,” the New York Post reported National Legal and Policy Center Director Tom Anderson saying.

Federal Taxpayer Funds Will Pay For Already-Existing Time Off Benefits

October 20, 2021

While Congressional Democrats tout paid family and medical leave as part of the massive social safety net expansion at the heart of a proposed $3.5 trillion 10-year spending plan, many Americans already have paid time off benefits.

The Build Back Better Act is a 10-year spending plan for so-called “human infrastructure,” including paid family and medical leave that would give all workers up to 12 weeks off with the average worker getting two-thirds of their regular wages to care for new children or an ailing relative “by blood or affinity.”

Proponents of the measure say it will ensure that even low-income workers will be covered. But people who live paycheck-to-paycheck can’t afford to take time off for a partial wage replacement, The Wall Street Journal editorial board recently argued.

They expect that the paid leave would be more likely to help middle-income people who can afford to live on partial pay and will make the middle class even more dependent on government.

But this spending isn’t necessary for many people who already have these paid time off benefits.

A 2017 Pew Research survey found that about two-thirds of workers who took leave in the last two years received some pay and a 2020 survey by the Society for Human Resource Management found that 55 percent of companies reported offering paid maternity leave.

Knowing that this benefit already exists in many places, the funding bill states that the federal government will reimburse up to 90 percent of what employers lay out for paid leave.

It would also reimburse states that have their own programs — New Jersey, New York and others.

If this benefit is available in many places, why spend taxpayer money on duplicating it?

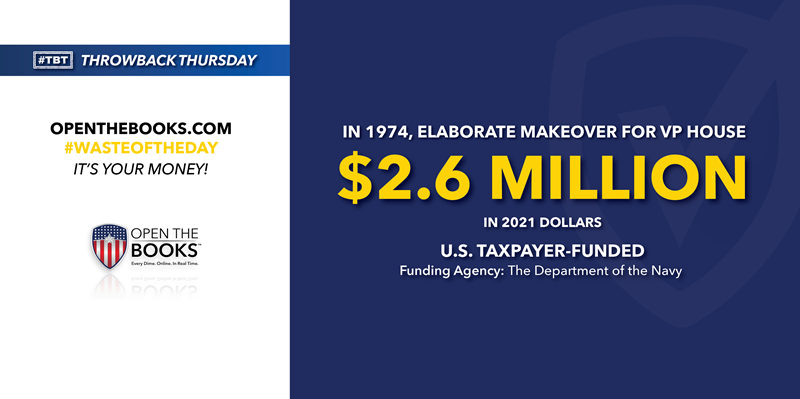

In 1974, VP’s Home Became a “Posh, Plush Pleasure Palace” Costing Taxpayers $2.6M

October 21, 2021

Throwback Thursday!

When Congress wanted to spend $15,000 in 1974 for maintaining and decorating the home of the chief of naval operations for the vice president’s use, Sen. William Proxmire objected.

The measure passed and the Democrat from Wisconsin was assured that “nothing elaborate was contemplated” and that only necessary furnishing would be done and cost $15,000 — $72,000 in 2021 dollars.

The house that was to become Vice President Nelson Rockefeller’s temporary home and the budget morphed into a $537,000 expenditure “for a posh, plush pleasure palace,” Proxmire said in awarding the Department of the Navy the Golden Fleece award in 1976 for wasting taxpayer funds.

The $537,000 — $2.6 million in 2021 dollars — included $41,100 for furniture; $33,000 for linen, silverware chests and accessories; $26,400 for drapes; $21,200 for silverware; $18,100 for carpets; $10,400 for China and $4,900 for crystal.

Proxmire also opposed the Navy’s plan to replace air conditioning window units with a $170,000 central air system.

“Even in the high-priced Washington area, this sum would finance a small housing development,” the senator said, going on to handing out 168 Golden Fleece Awards between 1975 and 1988 for wasteful and nonsensical government spending.

No doubt a $2.6 million expenditure to decorate a house was a waste of taxpayer money.

$2.9T in Tax Increases Slated for Reconciliation Bill

October 22, 2021

The Democrats are on their own to try and pass a $3.5 trillion reconciliation bill known as the Build Back Better Act without Republican support, as it is a massive expansion of the social safety net and includes an increase in taxes.

A five-page memo recently sent around by Hill aides shows $2.9 trillion in tax increases, the largest increase in decades.

About $1 trillion will come from raising taxes on high-income Americans, Fortune reported. Democrats would raise the tax rate for Americans making over $400,000 from 37 percent to 39.6 percent, where it was before President Donald Trump cut taxes in 2017. The top capital gains rate would also be increased from 20 percent to 25 percent.

There would be a 3 percent surtax on people with adjusted gross income over $5 million.

Corporate tax rates for businesses with income over $5 million would increase from 21 percent to 26.5 percent. Small businesses with income below $400,000 would see their rate lower to 18 percent and all of those in between will have their rate remain the same, at 21 percent.

Democrats want to increase tax enforcement by the Internal Revenue Service as a way to pay for the cost of the package, CBS News reported, and close a $166 billion per year gap between what’s owed and what’s paid.

The proposal calls for banks reporting to the IRS when the total amount going in and out of an account annually reaches $600, not individual transactions like how the money was spent, USA Today reported.

American banking lobby groups are trying to kill the proposal, which they argue would create "reputational challenges" for large financial services firms, increase the cost of tax preparations for Americans and small businesses, and create serious "financial privacy concerns,” Reuters reported.

The #WasteOfTheDay is presented by the forensic auditors at OpenTheBooks.com.