Image captured from the teen series Euphoria aired on HBO that critics characterized as soft-porn for teenage audiences.

By Adam Andrzejewski, OpenTheBooks CEO/Founder | Published at Substack

TOPLINE:

While Gavin Newsom locked down K-12 public schools, forcing students into remote learning from home, two harmful television series were airing – funded with $94.2 million from California’s Firm and TV Tax Credit program.

“13 Reasons Why,” seasons 1-4, produced by Paramount, received $45.8 million in reserved tax credits. The National Institutes of Health (NIH) linked the television series to a spike in teen suicide.

“Euphoria,” the pilot and seasons 1-3, produced by Warner Brothers, received $48.4 million in reserved tax credits. The television series came under fire as soft-porn for teenagers – glamorizing sex, violence and drug use in a high school setting.

Although “13 Reasons Why” was last selected for its tax credits while Newsom was Lt. Governor, “Euphoria” received its last tranche of credits while Newsom was governor and will air in 2024.

And although the governor and his wife, Jennifer Siebel Newsom, have made teen mental health a top public concern, neither spoke out against either series.

But that’s not surprising when you follow the money…

“13 Reasons Why” was distributed by Netflix and produced by Paramount. “Euphoria” was distributed by HBO (a Warner Bros company) and produced by Warner Bros. Discovery. All were companies with executives that massively funded the Newsom campaigns.

KEY FACTS:

-

Paramount, its executives, and employees gave Newsom $84,773 in campaign donations during the period 2018-2022. Paramount is owned by National Amusements, a merger of CBS and Viacom and later rebranded under Paramount Global.

-

Warner Bros. Discovery, its executives, and employees gave Newsom $96,280 in campaign donations. The company was formed in 2022 by a merger between WarnerMedia, which spun off from AT&T, and Discovery, Inc.

-

Netflix co-CEO Reed Hastings gave the anti-recall campaign against Gov. Newsom $3 million and company executives and employees gave Newsom’s campaign fund $170,000 in donations.

KEY BACKGROUND:

The state of California runs a $330 million annual tax credit program through the California Film Commission, intended to incentivize filmmakers to produce their projects in the Golden State. The third iteration of the program, 3.0, is set to run from July 2020 – June 2025.

In January 2023, Gavin Newsom proposed extending the program for another five years at $330 million a year, to 2030—a total of $1.65 billion.

The California state legislature followed suit, proposing a budget with such extensions in June 2023, along with additional diversity requirements for projects receiving credits. Newsom signed the extension in July.

Tax credits also became “refundable” this year, meaning companies can get cash back, rather than just reducing their tax liability. The refund, if claimed, will be issued at a 90% value over five years.

Netflix, one of the biggest winners of California tax credits, previously told shareholders that it has more credits than it can use, and lobbied for credit refundability. Since the 3.0 iteration of the program started, the company has been allocated nearly $180 million in tax credits.

Supporters of the tax programs, including Gavin Newsom, argue it is an important tool to keep jobs, private sector spending, and industry innovation in the state.

Critics of the programs contend the tax incentives do not create permanent jobs or encourage new economic activity. Rather, critics say, economic benefits accrue to big studios while states race to the bottom to offer bigger and better tax deals.

KEY QUOTE:

After Gavin Newsom signaled his support for extending the Film and TV Tax Credit in 2022, California Film Commission Executive Director Colleen Bell stated in a press release:

“The governor’s announcement today speaks to the values held by so many people across the film and TV production industry. More than ever, California offers the best value and the best values."

LEGALIZED PAY TO PLAY?

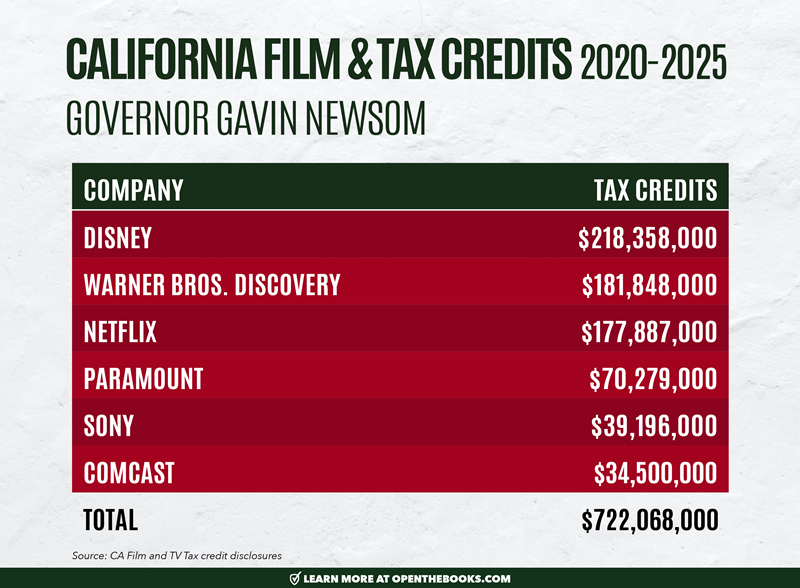

In total, Gov. Newsom or his unaffiliated anti-recall committee received at least $4.1 million in donations from entertainment companies, their executives, or employees since 2018. Those six companies collectively received $722,068,000 in reserved tax credits since 2020 (see chart below).

These donations were significant and represented the equivalent of more than 17-percent of the current cash on hand – $24 million – in the governor’s campaign committee as of 08/01/2022, according to disclosures.

In California, at arms length, pay to play is legal and there are no statewide prohibitions on campaign donations from state vendors or tax credit recipients.

ANOTHER SURPRISING FACT:

Other shows subsidized by California taxpayers feature gratuitous gun violence, an ironic state export given the governor’s extremist stance on gun control. Some of these films include:

-

“Bullet Train”; Sony; $10,241,000 in reserved tax credits. Reviews on movie rating website IMDB rated “Violence & Gore” in this film “severe,” with one reviewer mentioning “over-the-top violence with guns and swords. Many people die bloody deaths.”

-

“Joker”: Folie A Deux; Warner Bros. Discovery; $19,744,000 in reserved tax credits. Set to be released in October 2024, this sequel to the 2019 Joker features the same psychopathic mass murderer as the titular character.

-

“The Gray Man”; AGBO; $20,000,000 in reserved tax credits. The plot features multiple murders and kidnapping as a CIA agent is hunted around the world by a violent sociopath.

WHAT TO WATCH FOR:

On Thursday, November 30, Gov. Newsom and Florida Gov. Ron DeSantis square off in a public debate billed as Florida vs. California. Will the merits of the California Film and TV Tax Credit be an issue?

A full 3,700 word oversight report of the California Film and TV tax credits, Hollywood Handouts, published by our auditors at OpenTheBooks is available for download here.

ADDITIONAL READING:

Invent Your Own Gender. Governor Gavin Newsom Encourages Youth With Millions In Taxpayer Support “You’re on a gender journey” – California K-12 schools teach students that genders are limitless.| OpenTheBooks.com | August 29, 2023

Newsome Twosome: Siebel Newsom’s Films – Shown In Middle Schools – Feature Porn, Radical Gender Ideologies, And Her Husband Gavin | OpenTheBooks.Substack | January 19, 2023

Newsom Twosome: Jennifer Siebel Newsom’s Charity Is Out Of Compliance But Solicits Donations From State Vendors & Governor’s Campaign Donors | OpenTheBooks.Substack | January 12, 2023

California Gov. Gavin Newsom Reaped $10.6 Million In Campaign Cash From 979 State Vendors Who Pocketed $6.2 Billion | OpenTheBooks.Substack.com | August 2022

Historic Announcement– California’s Books Are Open – 201,000 Vendors Received $87 Billion In State Payments | OpenTheBooks.Substack.com | August 2022