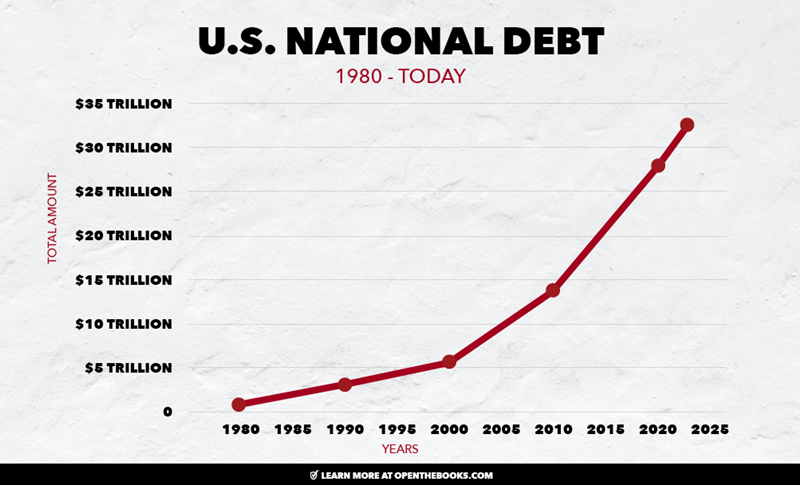

Graph: Since 1980, the U.S. national debt increased from less than $1 trillion to nearly $33 trillion today (2023).

By Adam Andrzejewski, OpenTheBooks CEO/Founder | Published at Substack

"Our national debt is our biggest national security threat," said Admiral Michael Mullen, Chairman of the Joint Chiefs of Staff, under President Barack Obama, at a "Tribute to the Troops" breakfast” in June 2010.

TOPLINE

Just weeks ago, U.S. debt was downgraded to AA from AAA by Fitch Ratings. It shook Wall Street with an intermediate market sell off. In Fitch’s view, “there has been a steady deterioration in the standards of governance over the last 20 years, including on fiscal and debt matters…”

Fitch continued…

Over the next decade, higher interest rates and the rising debt stock will increase the interest service burden, while an aging population and rising healthcare costs will raise spending on the elderly absent fiscal policy reforms.

In 1980, the U.S. national debt was less than $1 trillion and today the national debt tops $32.5 trillion. This out-of-control, bipartisan spending now threatens the long-term foundational underpinnings of the country.

THE CRITICS

“Democracy never lasts long. It soon wastes, exhausts, and murders itself. There was never a democracy yet that did not commit suicide.” – John Adams

In 2012, the legendary U.S. Senator, the late Dr. Tom Coburn, wrote the book, The Debt Bomb:

“In a nation whose debt has outgrown the size of its entire economy, the greatest threat comes not from any foreign force but from Washington politicians who refuse to relinquish the intoxicating power to borrow and spend.”

THE BIPARTISAN SPENDING PROBLEM

Our national debt has exploded under each president since 1980. From Ronald Reagan, George Bush, Bill Clinton, George W. Bush, Barack Obama, Donald Trump, and Joe Biden, our national debt is as large as our economic output (GDP).

-

In 1980, the national debt was $908 billion and $2.6 trillion when Reagan left office in 1988.

-

Under four years of Bush, the debt rose to $4 trillion and then $5.7 trillion under the eight years of Clinton.

-

With W. Bush, over two terms the debt rose to $10 trillion and then $19.6 trillion after eight years under Obama.

-

When Trump left office after one term the debt was $27.8 trillion.

-

Today, after two years under Biden, our national debt pushed $32.5 trillion.

INTEREST PAYMENTS VS. CORE SERVICES

In 2022, the federal government paid $476 billion just in interest on our national debt with the projection by the Congressional Budget Office to $640 billion this year. Net outlays for interest nearly double over the period in CBO’s projections, rising from $739 billion in 2024 to $1.4 trillion in 2033.

Here’s how that compares to the budgets of defense, social security and education.

In FY2023, the Department of Defense spent $773 billion. Social Security had outlays of $1.3 trillion. Education spending at the local, state, and federal levels amounted to $837 billion as of FY2021.

VALUE OF A U.S. DOLLAR

When the federal government adds to the national debt by spending more money than it takes in, it devalues the dollars. For example, today’s dollar would be worth 14 cents in 1972. Because of inflation, you need over $7 today for the equivalent spending power of $1 in 1972.

Unfortunately, our federal government’s spending is not slowing down. Our national debt will exceed 225% of GDP by 2050, according to the Penn Wharton budget model.

SUMMARY

On the world stage, the Chinese are taking every step to undermine the U.S. as the world’s reserve currency. These threats are not a new phenomenon.

However, as the Fitch downgrade of U.S. debt shows, American policy makers are not taking our fiscal condition seriously.

Great Britain with the pound took over as the world’s reserve currency in 1815. Then, in 1944 at the Bretton Woods Conference the U.S. dollar replaced the pound. Now, it has only been 80 years.

America needs a bold plan to stop Washington from bankrupting the country. Unfortunately, the long-term trend is aggressively moving in the wrong direction.

Breaking down the Fitch downgrade of U.S. debt on The National Desk. August 2023