Feds Paid For Blockbusters, Bowling Alleys, Arcades, ‘Privatizing Profits, Socializing Risks’

9:31 PM 09/07/2016

A decade after the advent of Netflix and well into the Internet age, one lender was still betting big on video cassettes: the federal government’s Small Business Administration (SBA).

The SBA repeatedly financed people’s plans to open Blockbuster Video stores in the late 2000s, when it was obvious to nearly everyone that such businesses were a sure ticket to bankruptcy.

Unsurprisingly, taxpayers ate the cost every time–part of $18 billion taxpayers lost through defaulted SBA loans to failed businesses in the last 15 years.

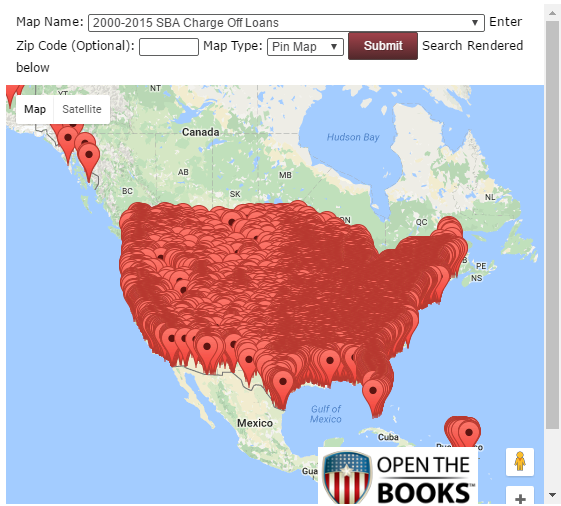

The findings come from a new report by OpenTheBooks.com, a non-profit government-spending watchdog and research group, examining how often SBA loans are not repaid.

The SBA was created originally to finance small businesses that couldn’t get loans from big banks, but in recent decades the agency has been heavily focused on steering non-competitive government contracts to "disadvantaged" and minority owned firms.

The new findings suggest that some people who attribute their inability to get traditional financing to discrimination by banks may instead simply have bad business ideas.

"One-hundred sixty thousand lending transactions defaulted since 2000 with taxpayers picking up the tab on $18 billion in failed lending. In some years, thirty-percent of all SBA lending was charged-off against SBA reserves (taxpayers)," OpenTheBooks said.

The SBA gave million dollar loans to people in the paper-printing industry as that industry was collapsing, as well as $15 million in failed loans to arcades and $60 million to bowling alleys, fun ventures with suspect financial prospects since 2000. The government ate $222 million in loans to daycare businesses, even though such businesses can often bootstrap by operating out of homes.

Adam Andrzejewski, founder of OpenTheBooks.com, told the Daily Caller News Foundation that the SBA model socializes the risks of business ventures, saddling taxpayers with the costs for failure, while allowing individuals to keep the profits if businesses succeed.

"The SBA lending tried to privatize profits while socializing risks. But, our oversight findings indicate that ‘other people’s money’ is a whole lot easier to waste."

The SBA says it fills a demand for when private lending comes up short, but investing in ventures like new brick-and-mortar travel agencies in the age of Expedia is a bet that "would have never been placed by private bankers" for good reason, he said.

Despite its image of mom-and-pop stores, SBA often financed luxury for people who hardly would seem to need special help, like $1.4 in failed loans for Lamborghini dealers and $45 million for country clubs. (RELATED: ‘Budget-Crunched’ VA Has 167 Interior Designers On Staff)

Many of the recipients weren’t exactly small businesses at all, but rather arms of major corporations, such as hotels that are part of giant chains. Holiday Inn, Comfort Inn and Days Inn franchises each accounted for more than $80 million in lost government funds.

Even as SBA treats individual franchisees as separate from the major companies that own them, the National Labor Relations Board is contending that when it comes to regulations like the minimum wage, they should be treated as large companies because of their affiliation with the parent company.

In 2012, President Obama promoted the SBA to a Cabinet-level position.

See bad SBA loans in your zip code by zooming in on this map from OpenTheBooks.com: