By Rachel O’Brien

Deputy Policy Editor, OpenTheBooks.com

In March 2020, at the height of the pandemic, millions of mom-and-pop businesses on Main Street were shut down during the economic lockdown. Congress created the Paycheck Protection Plan (PPP) to provide Covid aid to those companies.

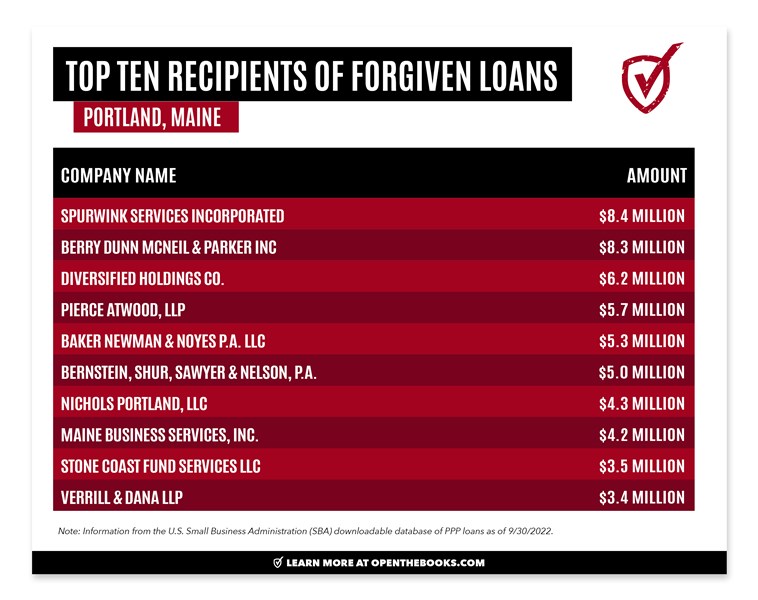

There were at least 72 businesses in Portland, Maine that have been forgiven loans of between $1 million and $10 million. These forgiven loans added up to $152 million by the Small Business Administration.

The loans were administered by banks all over the country and backed by the SBA to help businesses keep their workforce employed during the Covid-19 pandemic.

The SBA has forgiven 95 percent of all its PPP loans, in full or in part, including billions of dollars in Maine.

OpenTheBooks.com reviewed the PPP loan data available on the SBA website to find the Portland companies.

The largest forgiven loan was $8.4 million for Spurwink Services Inc., a non-profit that provides mental health and educational services for children and adults.

Accounting and management consulting firm Berry Dunn McNeil & Parker Inc. was forgiven an $8.3 million loan. Berry Dunn’s website says it is the largest accounting and management firm headquartered in New England.

The accounting firm was ranked the 49th in the country according to Inside Public Accounting in its 2022 survey. In 2021, Berry Dunn had $118.1 million in net revenues. Between 2020 and 2021, the firm’s revenues grew by 18 percent accounting to AccountingTODAY.

Did Berry Dunn and its partners need $8.3 million in Covid aid? For example, in 2020, Berry Dunn had $100.9 million in net revenues (26 percent growth). In 2019, the firm’s revenues were approximately $80.1 million.

Diversified Holding Co., a venture capital and private equity company, took a $6.2 million loan that was forgiven. Still owned by the Hildreth family, their story starts in 1949 when Horace Hildreth Sr., the former governor of Maine, president of Bucknell University and U.S. ambassador to Pakistan, founded the company. The company continued acquisitions in 2020 and 2021 according the press section of its own website.

Law firm Pierce Atwood, LLP, one of Maine’s largest law firms, was forgiven a $5.7 million loan. Pierce Atwood had 2021 revenues of $41.6 million according to Zippia and was a top 300 law firm in the country.

The law firm Bernstein, Shur, Sawyer & Nelson, PA took a $4.9 million loan that was forgiven. In March 2020, a few weeks before pandemic shutdowns began, the firm announced a substantial increase to its vacation and paid time off policies retroactive to the start of the year. Did taxpayers end up subsidizing the vacations for these lawyers?

Here are the top five categories of businesses receiving the most PPP forgiven funding:

|

Full Service Restaurants

|

$41,729,700.16

|

|

Lawyers

|

$29,765,644.27

|

|

Hotels & Motels

|

$15,830,401.22

|

|

Certified Public Accountants

|

$14,682,071.38

|

|

Residential Care Facilities

|

$8,626,213.5

|

One of the largest New England accounting firms, Baker Newman & Noyes P.A. LLC, took a $5.3 million loan, which was forgiven. Revenues in 2020 were $50 million and the same as 2019, according to AccountingTODAY. The firm ranked 91st largest in the country.

Non-profit home care company New England Life Care, Inc. received $5.3 million. Property management company Preservation Management, Inc. got a $3.2 million loan forgiven, among many other businesses.

Art supply store Artstock had a $2.3 million loan that was forgiven and another $2 million loan that wasn’t forgiven.

Homeless services organization Preble Street had a $1.3 million loan that was forgiven and a $2 million loan that wasn’t forgiven.

There were 47,407 loans given to businesses in Maine, according to an analysis by ProPublica – the vast majority(43,202) were for $150,000 or less, while 3,784 loans were between $150,000 and $1 million, 272 loans were for between $1 million and $2 million, 105 got between $2 million and $5 million and 23 got between $5 million and $10 million.

NOTE: All data is from September 30, 2022 and is posted for download at the U.S. Small Business Administration (SBA) website.

Learn more at OpenTheBooks.com.