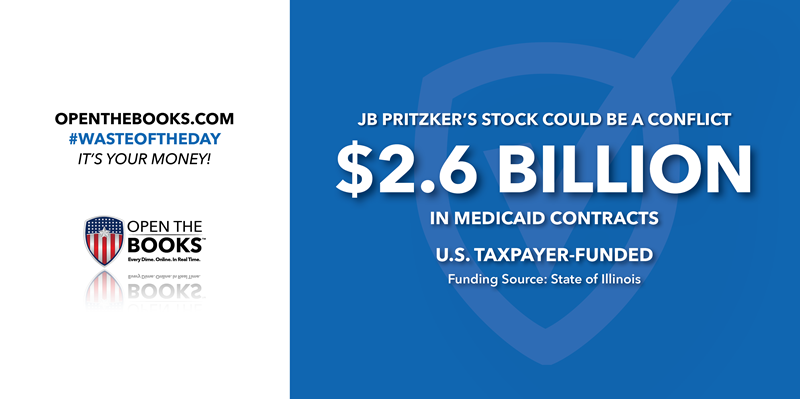

Illinois Governor Invested in Company With $2.6 Billion In State Contracts

March 28, 2022

Amid the national debate over whether members of Congress should be able to trade stock, the governor of Illinois is demonstrating how prevalent conflicts of interest are for elected officials who own securities.

In 2020, Gov. JB Pritzker’s trust bought stock in the health insurance company Centene Corp. That same year, Illinois gave $2.6 billion worth of Medicaid contracts to Centene Corp.

An investigation by the Better Government Association, a nonprofit Illinois watchdog, uncovered these interesting investments. Even though Pritzker’s investments are in a blind trust, which means that Pritzker is not privy to investment decisions, they demonstrate why blind trusts can’t prevent conflicts of interest.

Each year, Pritzker receives a copy of his current investments from his fund managers, which have the potential to influence the state contracting process.

Pritzker, a member of the family that owns the Hyatt Hotel dynasty, has a net worth of $3.6 billion, according to Forbes.

During his 2018 campaign, he pledged to purge his investment portfolio of companies that held state contracts, according to the report.

However, in 2020, his portfolio managers invested in Centene Corp., one of Illinois’ largest Medicaid contractors, according to the association’s report. While not illegal, the association’s experts say Pritzker could have instructed his trust managers not to invest in state contractors to eliminate the potential for a conflict of interest.

Pritzker and his trust managers refuse to disclose how much the investments are worth nor when the investments were made. All that has been disclosed so far is that his stake in Centene Corp is worth over $5,000, according to his Statement of Economic Interest form filed with the state.

These investments should serve as a wake-up call for investment reform for public officials. Public servants should be transparent when it comes to investing.

Brooklyn Gang Members Stole $4 Million in Covid Funds

March 29, 2022

Eleven gang members with ties to the dark, violent “drill rap scene” in Brooklyn were arrested in February for allegedly attempting to turn Covid-19 relief programs into a “bottomless ATM,” NYPD officials and federal prosecutors said. The group conspired to steal $20 million in unemployment funds and managed to steal $4.3 million.

According to the NY Daily News, a federal probe by the Department of Labor Inspector General’s office revealed that the suspects used stolen identities to fraudulently claim unemployment benefits via ATM cards, direct deposits, and paper checks, making it easy for criminals to cash in on one identity after another.

“The result of this was like gang criminal magic,” NYPD Deputy Commissioner for Public Information John Miller told the Daily News. “It was a never-ending spigot of money, because when you tapped out the funds from one identity, you simply moved on to another, and to another, and to another.”

After cashing in, the suspects celebrated with trips to California, housing rentals, luxury cars, and celebratory social media posts displaying stacks of cash, the newspaper reported. Some even rapped about it in a YouTube video, “Trappin’,” where they rap the lyrics “Unemployment got us workin’ a lot.”

One suspect, Romean Brown, even pondered on Facebook whether he should expand his operations to get even more false identities, defiantly declaring “S--- is too easy,” according to the Daily News. He was later pulled over for running a stop sign, and police found three unemployment benefits ATM cards on him, according to federal prosecutors.

While small businesses were struggling to stay open and laid off employees were struggling to make ends meet, these criminals took advantage of lax oversight.

$281 Billion in Improper Payments in 2021

March 30, 2022

In 2021, $281 billion of taxpayer money was improperly spent, according to a Government Accountability Office report.

Improper payments are payments made by the U.S. government that should not have been made or have been made in an incorrect amount. Each year, the Treasury Department quantifies the prior year’s improper payments and the GAO audits them.

At OpenTheBooks.com, we reported that trillions have been improperly spent since 2004.

In 2021, the Treasury admitted to over $281 billion in improper payments, a $75 billion increase from the $206 billion in improper payments the GAO found in 2020.

One might think the increase came from massive Covid-19 relief programs. However, the auditors generally excluded major relief programs like the Paycheck Protection Program from their analysis, meaning the amount may be much higher.

Improper payments accounted for 18.9 percent of all government transactions in 2021, more than double than in 2020. An increase in outlays for unemployment insurance also contributed to more improper payments, according to the report.

The most disturbing part of the report, however, is when the GAO notes that there is a “material deficiency” in the government’s ability to “determine the full extent to which improper payments occur and reasonably assure that appropriate actions are taken to reduce them.”

It also found the government can’t “identify and resolve information security control deficiencies and manage information security risks on an ongoing basis.”

Not only is the government making an increasingly-large sum of improper payments each year, it also doesn’t know what to do about it.

Time is running out. A growing debt-to-GDP ratio makes it harder to get out of the hole we’re digging. The more debt we’re in, the more wasted money harms the U.S. economy.

Throwback Thursday:

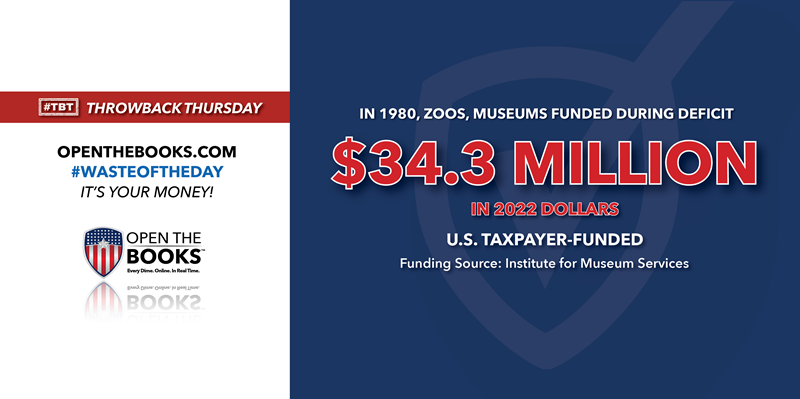

In 1980, Zoos and Museums Received $9.5 Million—Adding to the U.S. National Debt

March 31, 2022

Throwback Thursday!

In 1980, the Department of Education’s then-Institute for Museum Services received $35,000 — $126,480 in 2022 — part of which was used to fly two zookeepers from California to attend a three-day elephant workshop in Tulsa, Oklahoma.

It was only a small portion of the $9.5 million the institute gave to zoos and museums that year, or $34.3 million in 2022 dollars. The funding came at a time when the federal government had a $74 billion budget deficit.

Sen. William Proxmire, a Democrat from Wisconsin, gave the Institute for Museum Services a Golden Fleece award for this misuse of taxpayer funds.

For the three-day elephant workshop, two zookeepers from the Santa Barbara Zoo were sent to learn about “new techniques for handling and caring for elephants.” Forty elephant keepers from 13 states attended the conference.

In addition to the elephant workshop, federal funds were also used to send another senior animal keeper from the Santa Barbara Zoo to the National Conference of the American Association of Zookeepers in Montgomery, Alabama.

As Sen. Proxmire deftly recognized, some of the money didn’t go to help feed the animals or keep their doors open, which was what the Institute for Museum Services initially claimed the grants would be used for.

Instead, it went to an activity that should have been paid for by the zoo, if they really thought the conference would have been helpful. There is nothing wrong with sending professionals to educational conferences, but that luxury should be paid for by the institution, not by the taxpayers, Proxmire argued.

He refers to this as a “put the money on a stump and run” program, where the federal government throws money at a target with little indication of need, questionable purpose, and lax oversight.

As Proxmire notes, “It is one thing for the federal government to provide for the common defense, but it is quite another for it to pander to pachyderms.”

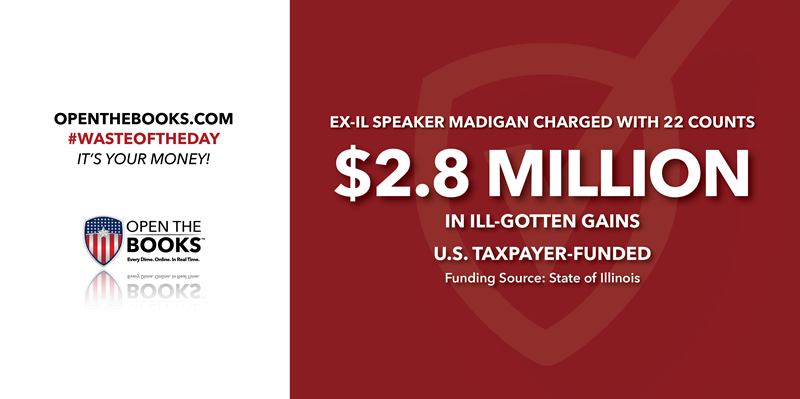

Former Illinois House Speaker Indicted on Alleged Racketeering Charge

April 1, 2022

Michael Madigan, the former powerful Illinois politician who served as the Illinois House speaker for 24 years, has been indicted by federal authorities on 22 counts of racketeering, The Chicago Tribune reported. Madigan’s right-hand man, Michael McClain, was also indicted on allegations of bribery.

Madigan, first elected to the Illinois House in 1971, resigned in 2021 after losing a bid for speaker while facing both sexual harassment allegations and a federal corruption investigation.

The investigation looked into a number of incidents of suspected corruption. A major part was his alleged involvement in a $2.8 million bribery scheme with electrical giant Commonwealth Edison, where the company paid thousands of dollars to Madigan’s lobbyists to get favorable state contracts, The Tribune reported.

Madigan is also accused of illegally soliciting business for his law firm during talks to turn a piece of state-owned land in Chinatown into a commercial development, according to the newspaper.

Former Chicago Alderman Daniel Solis helped bring down Madigan by secretly cooperating with federal authorities during the Chinatown land probe, The Tribune reported.

The indictment also alleges that Madigan met with Gov. JB Pritzker in 2018 to discuss giving Solis a lucrative state board position to thank him for helping Madigan get business for his firm.

In a statement to the Tribune, Pritzker claimed he “does not recall” that conversation.

Madigan denied the allegations, claiming that prosecutors are trying to criminalize legal political actions like job recommendations.

The #WasteOfTheDay is presented by the forensic auditors at OpenTheBooks.com.